Welcome to our comprehensive guide on how to invest in the thriving real estate market of Dubai without the need to purchase a home. Our team of experts has compiled a wealth of information to help you navigate this exciting investment avenue. Whether you’re a seasoned investor or new to the world of real estate, we’ve got you covered with practical insights, strategies, and tips to make informed decisions.

Table of Contents

Dubai’s Real Estate Market Overview

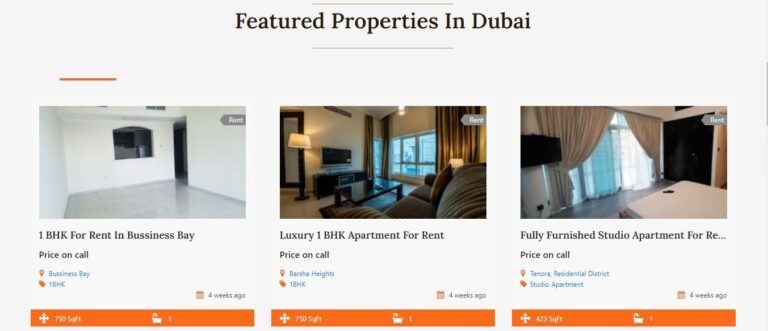

Dubai, known for its stunning skyscrapers, luxurious lifestyle, and vibrant economy, has consistently attracted global attention in the real estate sector. With a diverse range of properties, from residential to commercial, the city offers opportunities beyond just traditional home buying.

Exploring Non-Traditional Real Estate Investment

In a market known for luxury residences, investors can still tap into real estate without directly buying a home. Creative avenues such as fractional ownership, real estate investment trusts (REITs), and property crowdfunding platforms have gained traction, allowing for diverse investment options.

Advantages of Non-Ownership Investments

Investors opting for non-ownership methods enjoy benefits like reduced financial risk, increased liquidity, and professional management of properties. These approaches democratize real estate investment, making it accessible to a wider range of individuals.

The Power of Fractional Ownership

Fractional Ownership: A Closer Look

Fractional ownership involves multiple investors collectively owning a property. This approach grants investors partial ownership, dividing both the costs and potential returns, making high-end properties more affordable.

Advantages of Fractional Ownership

- Diversification: Spread your investment across various properties, reducing exposure to a single asset.

- Lower Costs: Share expenses with co-owners, including maintenance, property management, and insurance.

- Access to Premium Properties: Enjoy the luxury of owning properties that might have been beyond your individual budget.

Embracing Real Estate Investment Trusts (REITs)

The REIT Revolution

REITs are investment vehicles that allow individuals to invest in real estate portfolios without owning physical properties. These trusts generate income through property leasing, rental income, and capital appreciation.

Advantages of REITs

- Liquidity: REIT shares are traded on stock exchanges, offering easy entry and exit options.

- Steady Income: REITs distribute a significant portion of their rental income as dividends to shareholders.

- Professional Management: Skilled experts manage properties within the REIT, relieving investors of day-to-day responsibilities.

Crowdfunding: Pooling Resources for Property Investment

Real Estate Crowdfunding Unveiled

Real estate crowdfunding platforms bring together multiple investors to collectively fund property acquisitions or developments. This method enables investors to participate with smaller capital amounts.

Advantages of Crowdfunding

- Accessibility: Start investing in real estate with a modest capital outlay.

- Diverse Portfolio: Spread your investments across various projects and locations.

- Transparency: Crowdfunding platforms often provide detailed project information and financials.

Frequently Asked Questions

FAQs About Investing in Dubai Real Estate without Buying a Home

How can I benefit from Dubai’s real estate market without purchasing a home?

You can explore options like fractional ownership, REITs, and real estate crowdfunding to gain exposure to the market’s potential without the commitment of home ownership.

What are the risks associated with non-traditional real estate investments?

As with any investment, there are risks involved, such as market fluctuations and potential project delays. Thorough research and understanding the investment model are crucial.

Are non-ownership investments suitable for beginners?

Absolutely! These options provide entry points for investors with varying levels of experience and capital. It’s advisable to start with thorough research and consult financial experts.

How do I choose between fractional ownership, REITs, and crowdfunding?

Consider your investment goals, risk tolerance, and preferred level of involvement. Fractional ownership offers tangible ownership, while REITs and crowdfunding provide more passive investment approaches.

Can I generate regular income from these investments?

Yes, both REITs and some fractional ownership arrangements offer regular dividends or returns, providing you with a steady income stream.

What role does market research play in non-ownership investments?

Market research is vital to identify promising projects, assess potential returns, and understand the demand and supply dynamics of the real estate market.

Conclusion

Investing in Dubai’s real estate market without purchasing a home has never been more accessible. By embracing fractional ownership, REITs, and crowdfunding, investors can diversify their portfolios, enjoy professional management, and potentially reap steady income.

It’s crucial to approach these avenues with proper research and a clear understanding of the associated risks. Remember, the key to success lies in informed decisions and strategic investments.